Enterprise Payments Platforms Powering the Next Era of Real-Time Business Transactions

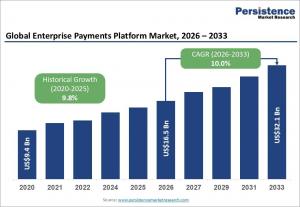

The enterprise payments platform market size is valued at US$16.5 billion in 2026 and is projected to reach US$32.1 billion by 2033, growing at a 10.0% CAGR.

BRENTFORD, ENGLAND, UNITED KINGDOM, February 4, 2026 /EINPresswire.com/ -- The enterprise payments platform market is undergoing a structural transformation as organizations modernize legacy payment infrastructures to support speed, scalability, and interoperability. These platforms act as centralized systems that orchestrate multiple payment rails, including cards, ACH, instant payments, wallets, and alternative methods, through API-driven architectures. Enterprises across BFSI, retail, manufacturing, and digital services are increasingly adopting these platforms to streamline transaction flows and ensure real-time settlement capabilities.

In 2026, the global enterprise payments platform market size is estimated at US$16.5 billion and is projected to reach US$32.1 billion by 2033, growing at a CAGR of 10.0%. This steady growth reflects enterprises prioritizing real-time, secure, and compliant payment operations. The BFSI sector leads adoption due to high transaction volumes and regulatory requirements, while North America dominates regionally owing to mature financial infrastructure and strong fintech innovation.

𝐆𝐞𝐭 𝐚 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/samples/32069

Market Statistics and Growth Landscape

The market’s growth trajectory is shaped by enterprises transitioning from fragmented payment systems to unified platforms that enable end-to-end payment visibility. Between 2020 and 2025, the market recorded a historical CAGR of 9.8%, highlighting consistent demand even before the surge in real-time payments and embedded finance. The forecast period from 2026 to 2033 builds on this momentum, driven by API standardization and cloud-native deployments.

Solutions account for the largest component share, representing nearly 65% of the market in 2026. This dominance is attributed to demand for real-time gateways, fraud detection, compliance automation, and reconciliation tools. Cloud-based deployment leads with over 55% revenue share, as enterprises seek scalability, faster upgrades, and reduced infrastructure costs in dynamic business environments.

Key Highlights from the Report

The global enterprise payments platform market is expected to double in value between 2026 and 2033.

North America accounts for approximately 35% market share due to advanced payment ecosystems.

Cloud-based platforms dominate deployment models with over half of total revenues.

BFSI remains the largest end-user segment driven by compliance and fraud management needs.

Asia Pacific is projected to be the fastest-growing regional market.

Real-time and API-driven payment capabilities are reshaping enterprise payment strategies.

Market Segmentation Analysis

The enterprise payments platform market is segmented by component, deployment mode, end-user, and payment type. By component, the market is divided into solutions and services. Solutions dominate as enterprises prioritize core platforms that support payment orchestration, compliance, analytics, and real-time processing. Services, including implementation and managed services, play a supporting role, particularly for large-scale integrations.

Based on deployment mode, cloud-based platforms lead due to their flexibility and compatibility with SaaS and embedded finance models. On-premise deployments persist in highly regulated environments but are gradually losing share. By end-user, BFSI leads the market, followed by retail, e-commerce, and large corporates, all of which require high-volume, omni-channel payment capabilities.

Regional Insights and Market Dynamics

North America remains the leading region, driven by early adoption of instant payments, open banking frameworks, and a robust fintech ecosystem. Enterprises in the U.S. and Canada invest heavily in API-enabled payment platforms to support real-time transactions and cross-border operations. Regulatory clarity further accelerates platform adoption.

Asia Pacific is the fastest-growing region, supported by rapid digital payment adoption, expanding smartphone penetration, and strong manufacturing and e-commerce activity. Markets such as China, India, and Southeast Asia are witnessing accelerated demand for scalable enterprise payment solutions that can handle high transaction volumes and diverse payment preferences.

𝐃𝐨 𝐘𝐨𝐮 𝐇𝐚𝐯𝐞 𝐀𝐧𝐲 𝐐𝐮𝐞𝐫𝐲 𝐎𝐫 𝐒𝐩𝐞𝐜𝐢𝐟𝐢𝐜 𝐑𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐨𝐟 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/request-customization/32069

Market Drivers Shaping Growth

One of the primary drivers of the enterprise payments platform market is the growing need for real-time and omni-channel payment processing. Enterprises are increasingly operating across borders and digital channels, requiring platforms that can seamlessly integrate multiple payment methods. Open banking mandates and API ecosystems further encourage platform adoption by enabling interoperability.

Another key driver is the shift toward cloud-native infrastructure. Cloud deployments reduce operational costs, improve scalability, and allow faster innovation cycles. Enterprises also benefit from enhanced fraud detection, compliance automation, and analytics capabilities embedded within modern payment platforms.

Market Restraints Limiting Expansion

Despite strong growth prospects, the market faces challenges related to data security and regulatory complexity. Enterprises handling sensitive financial data must comply with varying regional regulations, increasing implementation complexity. Concerns around data breaches and cyber threats can delay adoption, particularly among risk-averse organizations.

Integration challenges also act as a restraint, especially for enterprises with deeply embedded legacy systems. Migrating to modern enterprise payments platforms requires significant upfront investment, skilled resources, and change management, which can slow adoption among mid-sized enterprises.

Market Opportunities on the Horizon

The rise of embedded finance presents significant growth opportunities for enterprise payments platform providers. By embedding payment capabilities directly into enterprise workflows and digital products, organizations can enhance customer experience and unlock new revenue streams. This trend is particularly strong in retail, logistics, and SaaS industries.

Cross-border payments also represent a major opportunity, as enterprises seek platforms that offer faster settlement, transparent fees, and multi-currency support. Innovations in instant payments and alternative rails are expected to further expand market opportunities over the forecast period.

𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐞 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.persistencemarketresearch.com/checkout/32069

Reasons to Buy the Report

✔ Gain detailed insights into enterprise payments platform market size, trends, and forecasts.

✔ Understand key growth drivers, restraints, and emerging opportunities shaping the industry.

✔ Analyze market segmentation by component, deployment, end-user, and region.

✔ Identify leading regions and fastest-growing markets for strategic expansion.

✔ Access competitive intelligence and recent developments from key market players.

Company Insights

FIS

Fiserv

ACI Worldwide

PayPal

Stripe

Adyen

Worldline

Global Payments

Mastercard

Visa

Recent Developments:

Several leading providers have expanded their cloud-native payment orchestration capabilities to support instant payments and open banking APIs. Additionally, strategic partnerships between fintechs and banks are accelerating the rollout of embedded finance solutions across enterprise platforms.

Related Reports:

Equipment-as-a-Service (EaaS) Market

Debt Settlement Solution Market

Pooja Gawai

Persistence Market Research

+1 646-878-6329

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.